Date and Time

Location

RSVP Information

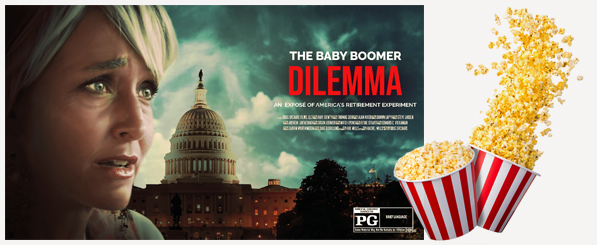

Baby Boomer Film – 7/28

Join Schilreff Wealth Management for an Exclusive Showing of the Baby Boomer Dilemma on July 28th!

2nd Showing

Baby Boomer Film – 8/2

Join Schilreff Wealth Management for an Exclusive Showing of the Baby Boomer Dilemma on August 2nd!

Theater Information:

Studio Movie Grill – Plano

4721 West Park Blvd, Plano, TX 75093

(469) 405-8527

Located in: Berkeley Square

Theater Information:

Studio Movie Grill – Plano

4721 West Park Blvd, Plano, TX 75093

(469) 405-8527

Located in: Berkeley Square

Register Now to Save your Spot!

RSVP at https://boomermovieevents.com/plano-july-28-email/

Upcoming Webinar

What Baby Boomers Need to Know

Social Security Webinar

Thursday Evening, August 11th at 6:30 pm

*Register Here Soon!